Despite increased diversification, wages and middle-class job growth remain concerns for the City’s economy

As New York City approaches the 10-year anniversary of the 2008 financial crisis, Comptroller Scott M. Stringer today released a first-of-its-kind report that looks at the diversification of the city’s economy. The report, “New York City’s Economy Has Become More Diverse: So What?” highlights that, although the City economy is more diversified than it was in 2000, it is not necessarily better positioned to weather future downturns or deliver long-term, robust economic benefits to working- and middle-class New Yorkers.

The new report examines the old adage that “when Wall Street sneezes, the City catches a cold” — and it examines the theory that a more diversified economy is less vulnerable to both industry-specific shocks, such as a financial market crash or a broader economic downturn. The report finds that New York City’s diversification since 2000 will likely yield stronger job growth in the future. At the same time, however, the analysis concludes that job growth will not necessarily be more stable, because many of the new jobs are just as vulnerable to an economic downturn as the jobs they replaced. The report also notes that middle class job growth has lagged behind lower wage sectors, where many of the new jobs are being created.

“We need to build a robust, thriving middle-class. Wall Street is still a big part of our economy, but we must keep nurturing burgeoning sectors that allow working New Yorkers to move up the economic ladder with good-paying jobs. From tech to healthcare, from education to the arts, industries that support working New Yorkers matter. We have to keep diversifying so that we aren’t too reliant either on Wall Street or jobs that would be susceptible to being lost in the event of a downturn. But we have to embrace a thoughtful approach,” said New York City Comptroller Scott M. Stringer. “While we’ve made extraordinary job gains since the Great Recession, we’re facing new challenges. This analysis shows that diversification by itself is not a panacea. The industries that are growing today are just as vulnerable as Wall Street. Our affordability crisis is mounting, wage growth is stagnant, and underemployment remains a concern. That’s why we need to take smart, strategic steps to build the resilient economy of the future, with higher wages, better working standards, and strong jobs for everyone.”

Specifically, the report found:

New York City’s Economy Has Diversified Since 2000

- Between 2000 and 2016, New York City’s economy has become modestly more diversified.

- Job growth has been strong: Since the 2008 recession, the number of jobs in New York City has increased by 15.8%, while the number of jobs on Wall Street has fallen by 5%.

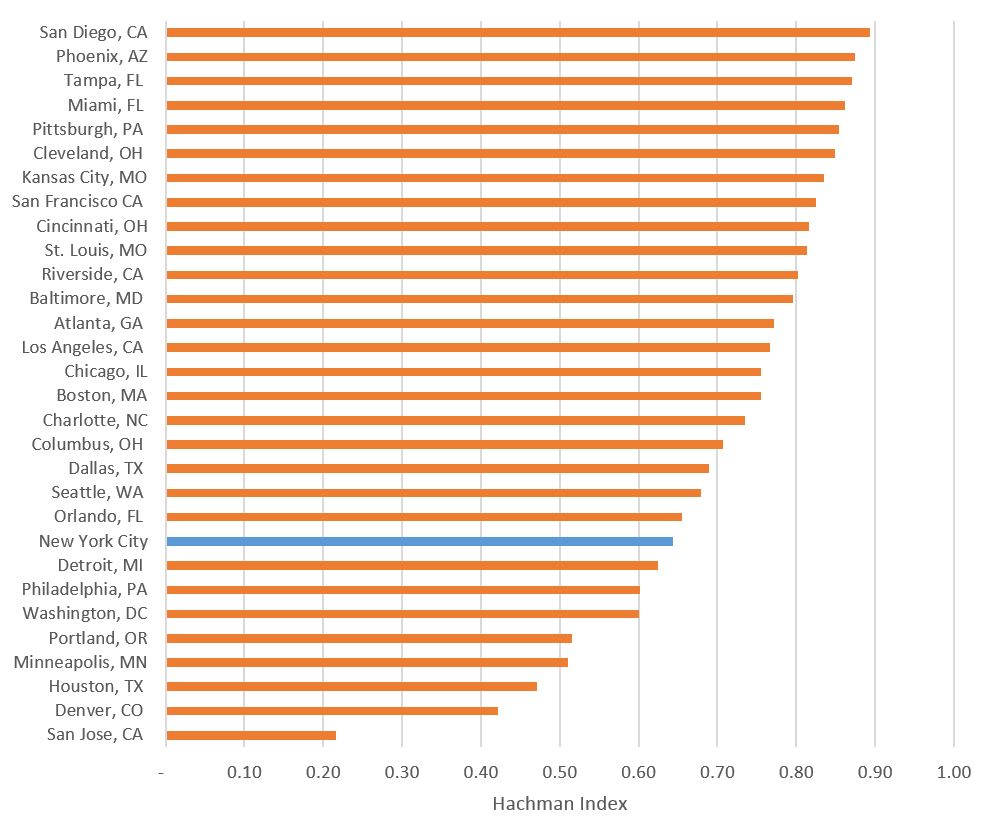

- Despite the increase in economic diversification, New York City still lags behind many other major metro areas — ranking 22nd out of the 30 largest metro areas, behind a number with significantly smaller economies, including Orlando, FL; Charlotte, NC; Cleveland, OH; Phoenix, AZ; Pittsburgh, PA; and Kansas City, MO.

The City Is Less Diversified than Many Other Major Metropolitan Areas

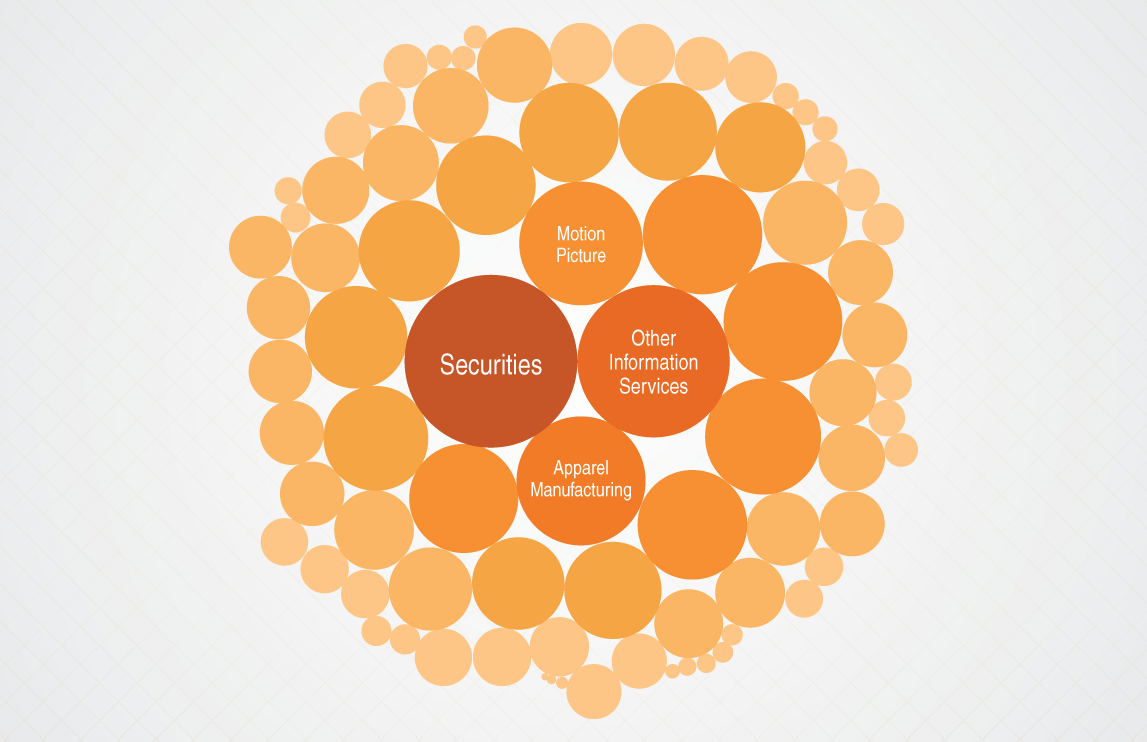

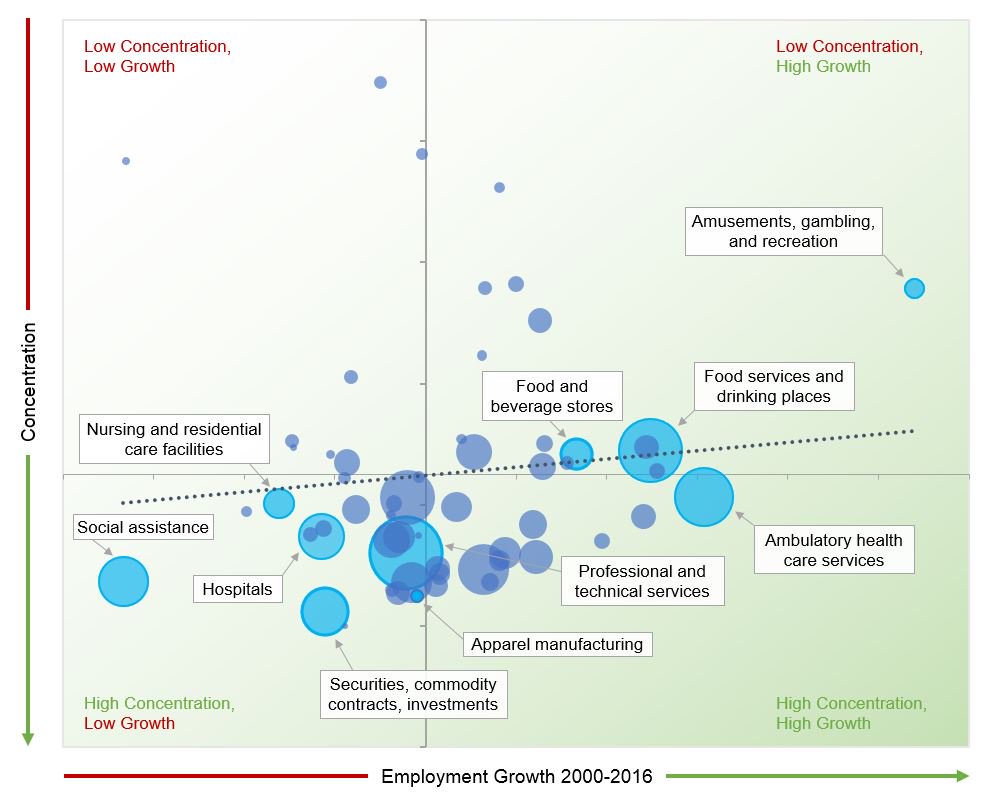

The analysis found that the increase in New York City’s diversification since 2000 occurred due to faster job growth in industries that were less concentrated, such as food services and ambulatory healthcare, and slower growth in those with higher concentrations (like finance and social assistance).

Diversification of the City Economy by Sector

Increased Economic Diversity Does Not Make New York City Less Vulnerable to Economic Downturns

Studies of major metro area economies have shown a connection between greater economic diversity and smaller employment and wage fluctuations during an economic downturn. This report examined if New York City’s increased economic diversity would lead to less vulnerability.

- The analysis found that the current composition of employment in New York City is expected to result in only minimally less volatility in the event of another economic downturn.

- Employment volatility declined from 2.2% in 2000 to 2.1% in 2016. This is because jobs in historically volatile sectors, such as finance (4.6% volatility), have largely been replaced by an even greater number of jobs in sectors that are almost as volatile, such as food services (3.3% volatility).

- The volatility of wage growth declined by a slightly larger margin, from 5.3% in 2000 to 5.0% in 2016. This is primarily due to the fact that the security industry’s share of jobs has decreased.

Diversification is Projected to Lead to Higher Job Growth

- The report found that the more-diversified New York City economy of 2016 resulted in projected annual job growth of 1.4 percent, compared to 1.1 percent under the less-diversified 2000 economy.

A More Diverse Economy Has Not Brought Higher Wages

- Job growth, however, doesn’t tell the full story. While the security industry is more volatile, it also has a far higher average wage, $375,000, compared to a citywide average of $86,000.

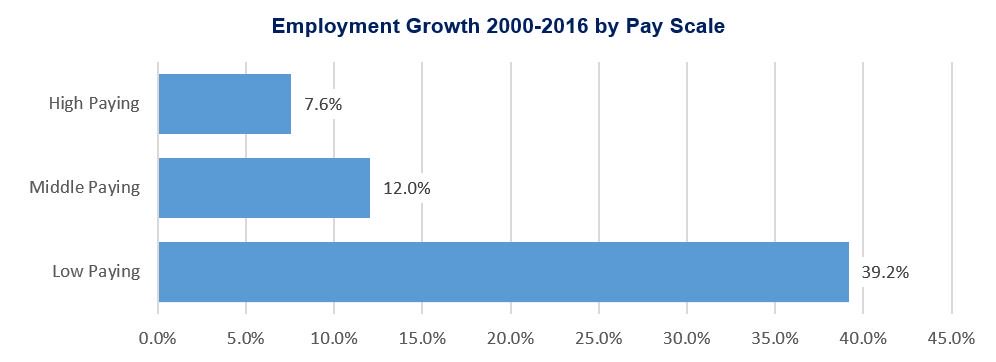

- As the city’s economy became more diversified between 2000 and 2016, the number of low-paying jobs skyrocketed. Specifically:

- The number of low paying jobs, with incomes below $45,000 a year, grew by 39.2%;

- The number of middle-income jobs, paying between $45,000 and $100,000 a year, grew 12%; and

- The number of high paying jobs, with incomes over $100,000 a year, grew just 7.6%.

- The Comptroller’s Office conducted an analysis to examine what the average income in the City would be in 2016 if the ratio of high, middle, and low paying jobs had not changed from 2000. Due to the larger number of high-paying Wall Street jobs in 2000, the average wage would have been approximately $92,000 in 2016 if the 2000 job composition had remained unchanged — higher than the actual 2016 average of $86,000.

Low-Pay Jobs Have Grown Most Rapidly

The Export Sector Has Declined, While Local Industries Boomed

- The report also found that the number of jobs in “traded” or “export” industries — like finance and media in New York City, which provide goods and services outside the local economy — fell by 69,000 from 2000 to 2016.

- At the same time, the number of local sector jobs, which provide services within the New York City economy, grew by 620,000.

- In 2016, the average job in a traded industry made $80,000 more than one in the local sector.

- Overall, traded industries represented 39% of employment and 53% of wages in 2000. In 2016, those rates had fallen to 31% and 48%, respectively.

The report concludes that as diversification has increased, the City’s economy has not necessarily become less volatile and wages for working- and middle-income New Yorkers have not grown significantly — despite continually rising job growth. It also highlights a number of policy focuses for the City in response to both the positive and negative aspects of our more diversified economy. They include:

- The City should continue to promote sectors that have existing strengths and can grow the middle class, such as tech, professional and business services, higher education, and finance.

- The city’s income distribution is becoming more U-shaped, with concentrations of high- and low-income households and fewer middle-income ones. The City must focus on keeping and creating more middle-income jobs and training New Yorkers to succeed in them.

To read the full report, click here.

No comments:

Post a Comment